TurboTax said on Friday that it would start depositing stimulus checks for millions of Americans who faced delays after a predictable IRS error.

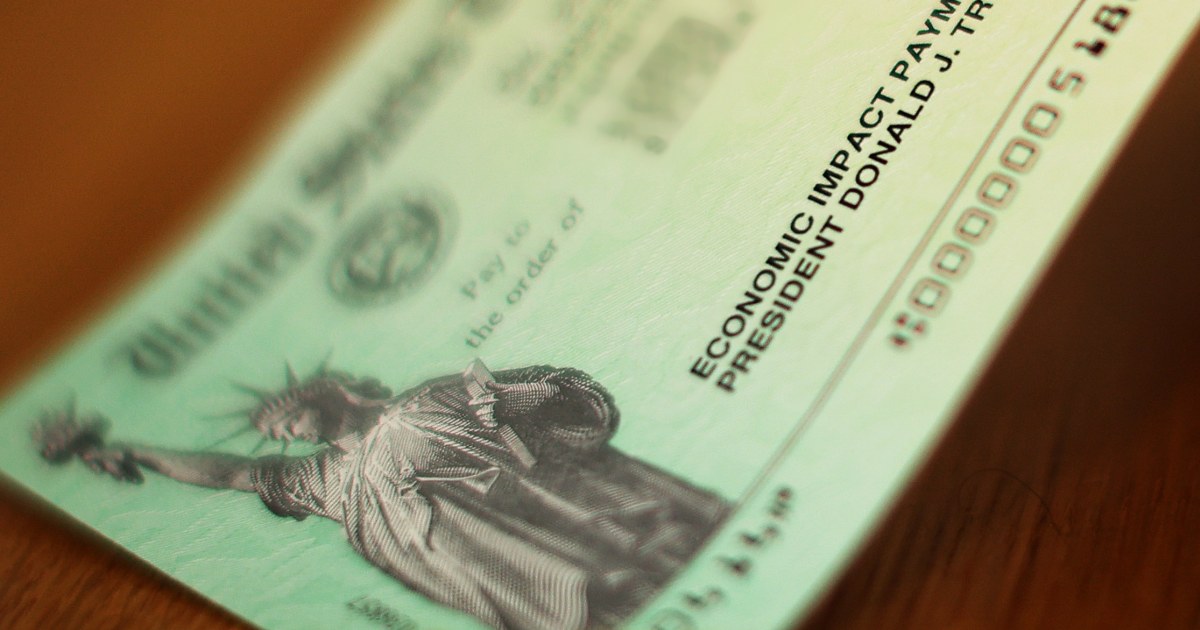

Up to 14 million people faced possible delays or uncertainties when companies closed alternative bank accounts in which economic impact payments would have been deposited, such as those used by tax preparation companies to process refunds for customers and rechargeable debit cards. The much-needed checks, a lifeline for families affected by the pandemic, “went back” to the IRS.

“Stimulus payments for millions of TurboTax customers affected by the IRS error will be deposited starting today,” said spokeswoman Ashley McMahon in an email to NBC News.

“We have been working tirelessly with the Treasury and the IRS to obtain stimulus payments to our clients,” wrote McMahon. “We know how important these funds are to so many Americans and we are sorry that an error by the IRS caused a delay.” The company is posting updates on its website.

Tax preparer H&R Block, whose customers have suffered the same frustrations, said in a statement that “it solved the problem for our customers earlier this week”.

Other tax preparation companies also blamed the IRS for their “mistake” and recommended that customers contact the tax preparer’s customer service for assistance. Spokesmen for rechargeable debit card companies said customers should contact the IRS.

Similar problems were also seen in April for some taxpayers, but no measures were taken to prevent them from happening again, experts in consumer law said.

The IRS did not immediately respond to a request for comment.

“If the second economic impact payment was sent to an account that is closed or no longer active, the financial institution must, by law, return the payment to the IRS, it cannot withhold and issue the payment to an individual when the account is no longer active, “the agency said in an online FAQ.

“The IRS informs people that, if they do not receive the full Economic Impact Payment, they must file their 2020 tax return electronically and request the Recovery Discount Credit on their tax return to obtain payment and any refunds as soon as possible. possible.”

TurboTax’s move followed the issuing of statements by members of Congress in response to inquiries by NBC News, attacking the IRS and promising to reform the agency under the new administration.

“I understand the Americans’ frustration if they did not receive their $ 600 relief check,” Senator Ron Wyden, D-Ore, a member of the Senate Finance Committee, told NBC News in an e-mailed statement. “Americans desperately need this relief and every day they go without it is a burden.”

“These difficulties are a symptom of Republicans’ decade-long effort to destroy the IRS budget and prevent the agency from doing its job,” said Wyden. “I will make improving IRS customer service a key component of our democratic reforms.”

In the spring, with the deepening of the economic and health crisis, 24 members of Congress sent a letter to the IRS, asking for answers on why some families and individuals had not yet received their relief checks, three months after the approval of the CARES Act.

“Americans need these relief checks to put food on the table and keep it warm. These checks are already overdue – any additional delay is unacceptable, ”Rep. Katie Porter, D-Calif., Who signed the letter, told NBC News in an e-mailed statement on Wednesday.

“Just as I asked for answers from the Trump Administration IRS last summer as to why some people had not yet received their relief checks, I will continue to pressure the agency until it really provides the help that Americans so desperately need during this crisis.”

The IRS is scheduled to send letters within two weeks of the payment being issued, telling taxpayers what to do if they have a problem, including not receiving it. More information and resources have been published online by the Consumer Financial Protection Bureau.

If the taxpayer does not receive payment of the stimulus, the only option to claim it may be in the next taxes. The IRS begins to accept 2020 tax returns in the coming weeks.

This will not be enough for desperate Americans who were betting on receiving the promised stimulus payment to put food on the table and avoid eviction.

“I was told that because we chose to pay our tax preparation fee for our 2019 refund, the stimulus was deposited in your bank account (H&R Block) instead of mine,” Cherish Long, 27, from West Memphis, Arkansas, told NBC News in an online message.

Recently unemployed, she planned to use the money to help pay rent and insulin that saves lives.

“Rent is officially overdue after today and I have enough insulin for the next day or so. Literally, everything depends on my husband. We don’t even qualify for food stamps, so this has been very difficult and stressful, ”said Long.

“This is the rental week for most of us,” Destinee Coleman, a 28-year-old from Florida, told NBC News in an online message. She said she filed with TurboTax and opted for “Refund Transfer” to pay the cost of filling out the refund request. “Many of us were counting on it to help pay the rent,” she said of her stimulus check.

Some of the low-income customers who used the “Refund Transfer” system that hindered them in the first place may have qualified for free filing services like VITA or IRS Free File.

Nearly 80 percent of taxpayers using reimbursement transfer products qualify for the Earned Income Tax Credit, a refundable tax credit for low-income families that fall 150 percent below the poverty line.

Americans spent nearly half a billion dollars in 2017 on products that help them obtain an advance or a tax refund loan and to declare taxes, according to a GAO report.