As 2020 comes to an end, it is difficult to find a more successful fund manager than Cathie Wood, chief executive and investment director at ARK Invest.

ARK’s main fund, ARK Innovation ETF ARKK,

jumped 154% this year, exceeding the 43% increase for the Nasdaq Composite COMP,

and other ARK funds, including the ARK Genomic Revolution ETF ARKG,

also had meteoric gains. The only really sour note came this week, with losses in the funds and, exclusively, exits. But, according to FactSet Research, the innovation fund attracted $ 9.4 billion in flows this year, the genomics fund swallowed $ 5 billion in assets and its next generation Internet fund ARKW,

attracted nearly $ 3 billion in flows.

In a note to customers this week, Wood said there are five “innovation platforms” that companies need to invest in or lose track of: DNA sequencing, robotics, energy storage, artificial intelligence and blockchain technology. These platforms involve 14 technologies, including gene therapies, 3-D printing, cloud computing, big data analytics and cryptocurrencies, she said.

This technological innovation puts at risk entire sectors of sectors – energy, industry, discretionary consumption, communication services, health and financial services, which make up more than half of the S&P 500 SPX,

she said.

Traditional stock and fixed income benchmarks are increasingly populated by so-called “cheap” value traps, stocks and bonds for a reason, she added.

There is an economic forecast associated with this revolution. “If our projections for the five innovation platforms are close to the mark, nominal GDP growth in the USA is likely to decline from 4.1% at an annual rate over the past five years to 2-3%, regaining momentum only after new developments. technologies and solutions gain enough critical mass to move the economic needle, ”she said. Both volume growth and inflation will be below expectations.

The buzz

Senate majority leader Mitch McConnell said he would not present a vote on $ 2,000 stimulus checks unless attached to provisions that would remove legal protections for companies, including the owner of Google Alphabet GOOG

and Facebook FB social media platform,

as well as establishing a commission to examine President Donald Trump’s unfounded allegations of electoral fraud.

The gambling markets continue to favor Republicans, while the latest polls in Georgia are tending towards Democrats occupying both seats in the second round of the Senate, which would give the party control of both chambers of Congress and also the presidency. .

The focus on the coronavirus front continues to be the slow distribution of vaccines in the United States, as much as the increasing number of victims that the virus is causing. Daily admissions reached 125,220 and deaths totaled 3,903, according to the COVID-19 screening project, while the Centers for Disease Control and Prevention reported that 2.8 million had started the vaccination process. China approved its first vaccine, from the state conglomerate Sinopharm 1099,

which says it’s 79% effective, while the U.S. may not approve the vaccine from pharmaceutical company AstraZeneca AZN,

until April, according to a senior health official from the Trump administration.

Oil producer Exxon Mobil XOM,

said in a document from the Securities and Exchange Commission that it plans to make a book value reduction of up to $ 20 billion in the fourth quarter.

The hedge fund Alden Global made a non-binding offer to buy the shares it does not yet own in Tribune Publishing TPCO,

for $ 14.25 per share. The Tribune closed at $ 12.79 on Wednesday.

The United States said it would subject the European Union to additional tariffs on aircraft manufacturing parts from France and Germany, non-sparkling wine from France and Germany and cognac, in what it said was a response to the EU’s calculation of how it imposed tariffs on the US. The broadest and longest dispute is over state aid to aircraft manufacturers Boeing BA,

and Airbus AIR,

Weekly unemployment insurance claims are the latest economic indicator due to launch in 2020.

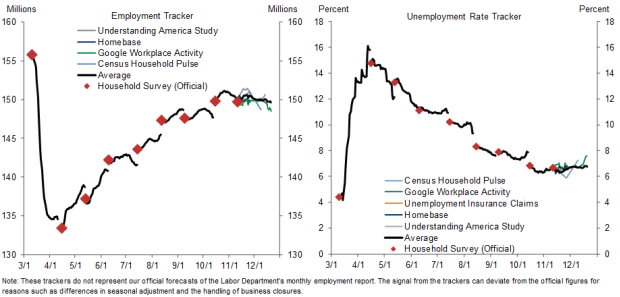

The graph

Ronnie Walker, an economist at Goldman Sachs, found that the job market hasn’t changed much – for better or for worse – since the November employment report. The good news is that there was not much healing effect with the COVID-19 pandemic. Two-thirds of the 25 million jobs initially lost since the start of the pandemic have returned, and 42% of new unemployed since February say they are on temporary layoff, he said.

The market

It looks like a peaceful end to a great year, with little movement in ES00 stock futures,

TMUBMUSD10Y obligations,

or the DXY dollar,

Bitcoin BTCUSD,

that was where the action was, with the cryptocurrency reaching $ 29,000.

Random readings

Becky Hammon became the first woman to lead a team in the history of the National Basketball Association, taking over the San Antonio Spurs on Wednesday night after Gregg Popovich was sent off in the first half.

UK Prime Minister Boris Johnson’s father said he is applying for French citizenship.

American rivers are changing color, satellite images show.

Need to Know starts early and is updated until the opening bell, but sign up here to have it delivered once to your inbox. The emailed version will be sent around 7:30 am Eastern.