(Bloomberg Opinion) – One of the most disturbing developments in business in 2020 was the tendency for electric vehicle companies to list on a stock exchange before they had their first earnings. Although it is standard practice for research-intensive life science companies, going public before having a product for sale is quite unusual in the automotive world.

And yet, pre-prescription companies like Nikola Corp. and Fisker Inc. achieved billions of dollars in valuations. Now, Californian battery startup QuantumScape Corp. took the craze for electric vehicles to a new level.

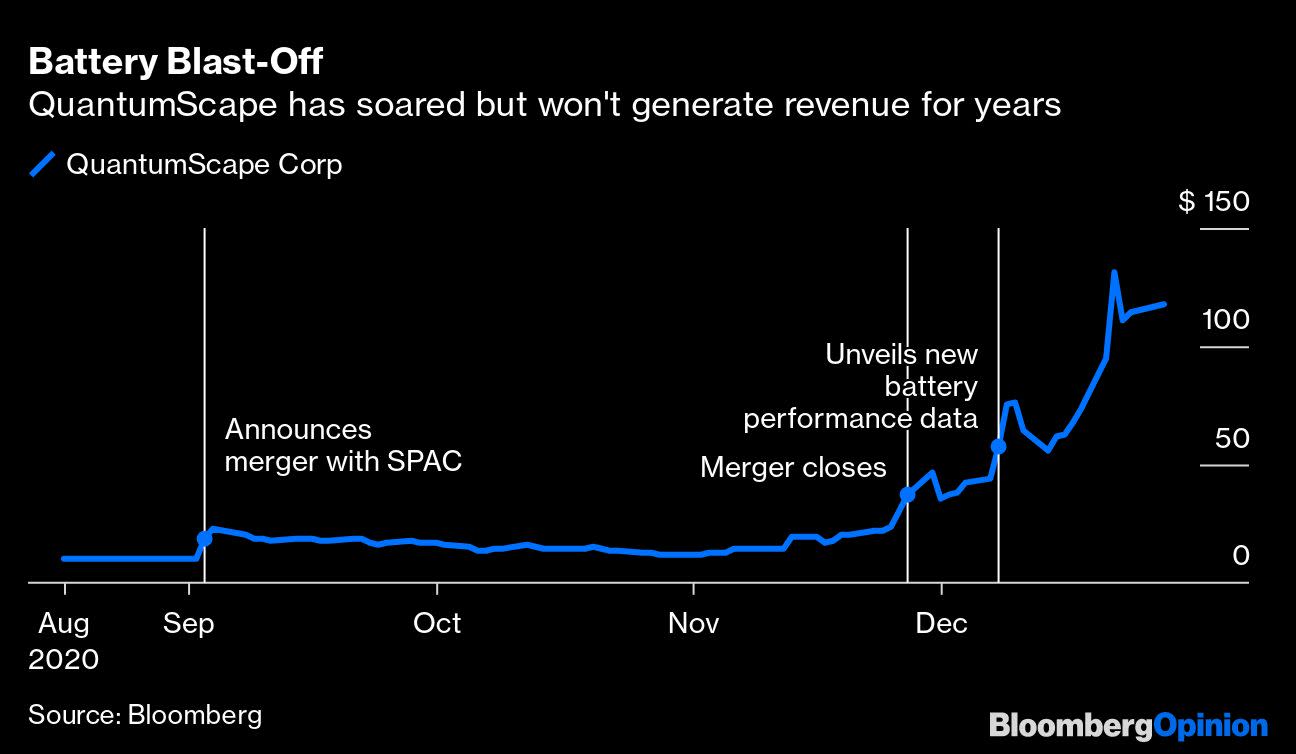

Founded by scientists at Stanford University a decade ago, with financial support from Volkswagen AG, QuantumScape became a public company in November after the merger with Kensington Capital Acquisition Corp., a special purpose acquisition company. The company will not generate significant revenue until 2026, but is already valued at $ 43 billion, or $ 51 billion on a fully diluted basis. (1)

From the climate point of view, it is great that investors are investing capital in electric transport. The promise of such wealth will encourage others to join the cause of reducing emissions. However, the same speculative fever that propelled Tesla Inc. and China’s NIO Inc. seems to have taken hold of QuantumScape investors.

An average of $ 2.8 billion of shares in the battery company traded daily during the past week. This is more than the volume of Alphabet Inc., whose market capitalization is $ 1.2 trillion. Technical factors may have contributed to the increase in QuantumScape: Only a small percentage of the shareholder registry is available for trading. (7) For retail investors who buy shares at these levels, there is a long way down.

First, the good news. In laboratory tests, QuantumScape’s “solid state” battery cells achieved very encouraging results, suggesting that innovative chemistry may one day allow electric vehicles to travel further and charge faster, at less cost. (2) This is exciting because it has become more difficult to extract significant performance gains from conventional lithium-ion batteries. CEO Jagdeep Singh’s team of scientists appears to have accomplished a real feat.

However, when the SPAC agreement was announced in September, the parties decided that a $ 3.3 billion valuation was appropriate. (6) This seemed broad for a company with fewer than 250 employees and which did not have a finished product or factory. After a run on the stock market, QuantumScape is now worth more than 10 times the starting value, and more than automakers like Ford Motor Co. and battery giants like Panasonic Corp. and Samsung SDI.

Those who bought Kensington SPAC shares in August saw a return of 1,060%, while QuantumScape guarantees that before sold for 80 cents, they are now worth 50 times more. (3) Stanford’s three founders – Singh, Fritz Prinz and Tim Holme – became paper billionaires. Volkswagen, which has invested about $ 300 million in QuantumScape, will have a 23% stake worth almost $ 10 billion. (4)

As with SPACs, the Kensington sponsor – controlled by Justin Mirro, a former investment banker at Moelis & Company and RBC Capital Markets – also did well. She received shares and guarantees worth more than $ 900 million, a huge return on her investment of $ 7 million or more and earned in just a few weeks of work. (5)

Other prominent QuantumScape sponsors include venture capital firms Khosla Ventures and Kleiner Perkins, Microsoft Inc. co-founder Bill Gates, billionaire hedge fund George Soros’s Quantum Partners and investor Jeremy Grantham. JB Straubel, a former chief technology officer at Tesla, is on the board. These endorsements and the years of R&D that have been consumed suggest that there is more here than just hype. The contrast to Nikola, whose own technology (or lack thereof) was the subject of a hard-hitting short-seller’s report, seems clear. (8)

Volkswagen’s production experience should facilitate the path to commercialization. The partners plan to start production at a small pilot facility in 2024 and then at a much larger plant two years later. But success is not guaranteed.

So far, QuantumScape has only produced single-layer cells and has yet to find a way to stack more than 100 on top of each other to create a battery pack. Competitors like China’s Contemporary Amperex Technology Co. will not sit idly by. CATL’s shares also rose this year, valuing it at around $ 110 billion.

An advantage of SPACs is that they can publish detailed multi-year financial forecasts, while companies that go public through a traditional initial public offering generally only publish historical finance. Given QuantumScape’s significant production hurdles, it would be unwise for investors to rely too heavily on these estimates, but whatever happens, they will have a long wait:

Even assuming that QuantumScape’s predictions prove to be accurate, the assessment seems disconnected from reality. The market capitalization is equivalent to 13 times the revenue the company expects to generate in 2027. Tesla’s shares are also incredibly frothy, but they are a comparative theft, just over 13 times the revenue expected in the next 12 months. Volkswagen, which will be QuantumScape’s biggest customer at the start, is valued at just 0.3 times next year’s sales.

QuantumScape batteries may end up driving the next generation of electric vehicles, but sustaining that assessment can be even more challenging than advanced battery chemistry.

(1) The count of 447.5 million fully diluted shares includes options for shares not exercised, units of restricted shares and additional shares issued to Volkswagen

(2) SPAC’s public shareholders represent only 5% of the shareholder register. QuantumScape’s current shareholders own 82%, some of which are not sellers or are subject to restrictions.

(3) The QuantumScape project does not require a manufactured anode, which keeps costs low. The lithium metal anode is formed when the cell is charged.

(4) When adjusted for QuantumScape money

(5) If QuantumScape decides to redeem them, the bonus will be converted to a maximum of 0.365 shares

(6) Volkswagen owns 71 million shares of QuantumScape, but will receive an additional 15 million, subject to the achievement of a technical performance milestone, according to S-1.

(7) Kensington sold shares in an IPO on June 30 and had already signed a non-binding letter of intent with QuantumScape just three weeks later

(8) QuantumScape also has many more patents, for example.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Bryant is a columnist for Bloomberg Opinion covering industrial companies. He previously worked for the Financial Times.

For more articles like this, visit us at bloomberg.com/opinion

Sign up now to stay up to date with the most trusted business news source.

© 2020 Bloomberg LP